$MATR token

$MATR TOKENS (THE “TOKENS”) ARE NOT BEING OFFERED OR DISTRIBUTED TO ANY RESIDENT OF OR ANY PERSON LOCATED OR DOMICILED WHERE SUCH OFFERING IS PROHIBITED, RESTRICTED OR UNAUTHORIZED IN ANY FORM OR MANNER WHETHER IN FULL OR IN PART UNDER THE LAWS, REGULATORY REQUIREMENTS OR RULES IN SUCH JURISDICTIONS, SUCH AS, BUT NOT LIMITED TO, UNITED STATES OF AMERICA, UNITED ARAB EMIRATES, SINGAPORE, AUSTRALIA.

$MATR TOKENS ARE OFFERED BY MATERA PROTOCOL FOUNDATION, INCORPORATED IN THE CAYMAN ISLANDS WITH COMPANY NUMBER 398250.

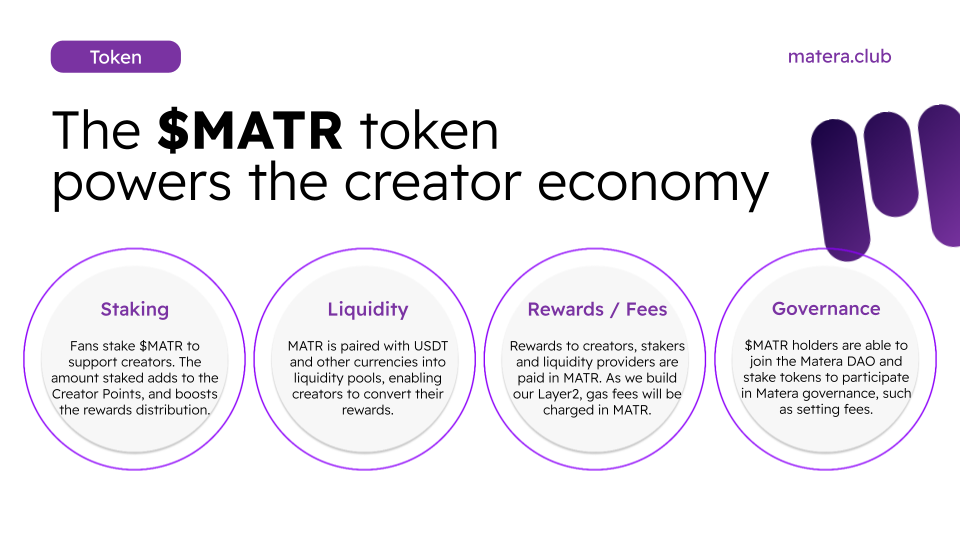

The Matera economy is built upon the MATR token, which mainly serves a dual purpose as a staking and liquidity token. This dual-token structure is reminiscent of the work of Cong et al. (2021) on tokenomics, which highlights the importance of balancing utility and liquidity in token-based systems.

Matera’s token economy is a system designed to incentivize participation, balance stakeholder interests, and support the growth of a circular economy for content creation and monetization.

Staking

The primary utility of the MATR token is as a vote-stake instrument, where holders stake to support specific creators. The amount staked adds to the Creator Points, and dictates the rewards distribution.

As seen in 2. Matera DeFi platform section, the distribution of rewards to each creator leverage mathematical principles to create a dynamic and adaptive reward distribution mechanism, so that it pays off to back a creator early before their rapid growth. This creates an incentive for users to back the right creators. These help to maintain equilibrium and are grounded in the principles of economic incentive design (Hurwicz & Reiter, 2006).

Rewards

When claimed, the Rewards are paid to Creators with MATR tokens. Creators can use DeFi platform to convert MATR into other currencies, using our liquidity pools. For web2 creators, off-ramp apps can be built directly on top of the Matera ecosystem to abstract this conversion and pay creators directly in fiat.

Liquidity

MATR is paired with USDT into a liquidity pool, enabling creators and users to exchange their MATR. LP tokens are created and distributed to liquidity providers. Additionally, new liquidity pools can be created between MATR and any whitelisted ERC20 token, which enables new partnerships and ability for users to exchange their tokens. For example, the MATR-DOGE pool could be created, and liquidity providers rewarded. The dynamic incentives of the model enable liquidity to form naturally, align and interplay with utility, driving the overall economic health of the platform.

Model Dynamics

The economic relationship between staking and liquidity needs to be recognised by the model in order to correctly align interests, and allow free markets to evolve on both sides of the ecosystem.

To allow this within the model, the combo between staking and liquidity is modeled using the original Liquidity Pool consisting of MATR+USDT. This special LP token COMBO has its own role and utility in the ecosystem: to determine fees and incentive of other liquidity pools. In the example of MATR+DOGE above, COMBO holders can vote on fees for that pair and redirect it back to the MATR+DOGE LP holders. This means, COMBO holders can incentivize new liquidity pairs to bring in liquidity and TVL, and/or reduce allocations to more mature pools. This helps to ensure that the system remains responsive to the needs of its stakeholders.

Governance

In web2, most of the value created on platforms accrue to the platform themselves. This is because platforms centralize the governance of the system and are able to set their own fees, change distribution algorithms, or censorship rules. As we progressively decentralize the governance of the model, Matera aims to create an open system where MATR token holders have the ability to vote or stake on core issues and decide on the governance of the creator economy, such as Matera Points calculation, the fees, distribution of creator rewards, and more.

Last updated